Choosing the best health insurance plans can feel confusing, especially with so many options. Many people worry about finding a plan that covers their family’s needs and still fits their budget.

Whether you want individual coverage, need protection for your whole family, or hope to select from affordable marketplace plans such as those on Healthcare.gov, making the right choice matters for quality care.

One fact stands out: leading providers like Blue Shield and UnitedHealthcare offer health plans that give access to trusted doctors and well-known hospitals across the country. This blog will explain what coverage these top companies offer, how HealthCare.gov works for families and individuals, what makes UnitedHealthcare’s network strong, and more.

You will learn which type of plan is right for your needs in 2025. Find out which insurance company could be your best fit next!

Key Takeaways

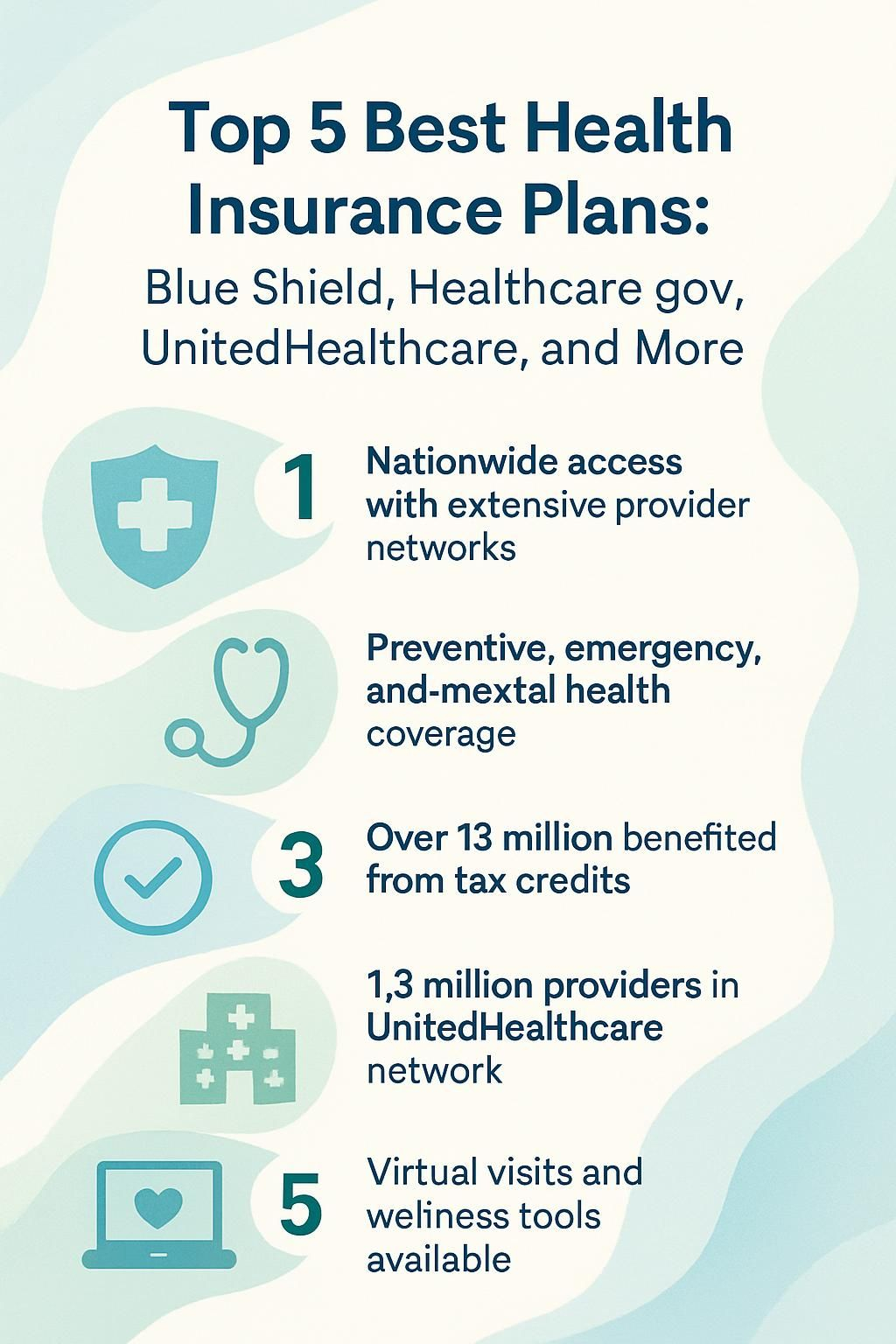

- Blue Shield and UnitedHealthcare stand out with extensive networks, presenting access to an array of doctors and hospitals nationwide. They offer assorted plans encompassing preventive care, emergency services, and mental health support, designed for both individuals and families.

- Healthcare.gov functions as a key portal for locating affordable health insurance options with its marketplace accommodating Bronze to Platinum tier plans. In 2024, over 13 million Americans gained from tax credits accessible through the platform, demonstrating its role in assisting lower monthly premium costs based on income brackets.

- UnitedHealthcare sets itself apart with one of the nation’s most expansive provider networks comprising over 1.3 million medical professionals and in excess of 6,500 facilities. Their adaptable plan options include HMOs, PPOs, Medicare Advantage Plans along with virtual visit features and wellness support tools adapted to suit various healthcare requirements and lifestyles.

What coverage does Blue Shield offer for families and individuals?

Blue Shield offers a range of health insurance options for both individuals and families, giving members access to an extensive network of doctors and hospitals across the country.

Many plans cover preventive care, doctor visits, emergency services, prescription drugs, mental health support, and vision care. Members can select from various individual and family insurance plans that fit different needs based on income or specific medical concerns.

Families enjoy comprehensive benefits in family health insurance plans such as wellness checkups for children, immunizations, maternity coverage, lab tests, specialty physician access within the Blue Cross Blue Shield Association network.

For those seeking flexibility in their medical insurance choices, Blue Shield provides Health Maintenance Organization options along with Preferred Provider Organization alternatives.

Some policies offer lower out-of-pocket costs if you use providers within the plan’s network; others may have higher deductibles but broader provider choices. You can review summary of benefits documents for each plan before enrollment during open enrollment.

From my personal experience using Blue Shield’s portal to find a doctor by ZIP Code was fast and straightforward; it helped me compare estimated prices before making appointments.

Healthcare.gov also helps people evaluate these types of coverage so you can choose a plan suited to your lifestyle or financial goals. As you look into affordable health insurance through Healthcare.gov next, consider how subsidies might help lower your monthly premiums even more.

What affordable health insurance options are available through Healthcare. gov?

Healthcare.gov offers a straightforward way to find a quality health insurance plan, whether you need coverage for yourself or your family. The Health Insurance Marketplace lists many types of health plans for individuals and families, including Bronze, Silver, Gold, and Platinum tiers.

Each level balances monthly premiums against out-of-pocket costs differently. Many people can pay less each month if they qualify for subsidies based on income; in 2024, over 13 million Americans used tax credits to lower the cost of their Marketplace coverage.

Medicaid also provides another option through Healthcare.gov for those whose income meets state standards.

A high net worth does not disqualify you from getting value with these plans; some clients choose higher premium options to access broader provider networks and exclusive medical services.

For instance, certain Gold or Platinum plans may include extra benefits such as wellness programs or increased mental health support that fit an active lifestyle with demanding schedules.

I once chose a top-tier Marketplace plan with low coinsurance because it let me see specialists quickly at leading hospitals without referrals or delays. Open Enrollment runs each year but qualifying events allow enrollment outside these dates if your life changes significantly—like marriage or starting a new business—to ensure you always have the right health insurance company supporting your needs.

A good summary of benefits and coverage helps you understand what’s covered before your plan starts.

What makes UnitedHealthcare’s network extensive and plans flexible?

Now that you know about affordable health insurance options through Healthcare.gov, it is essential to see how UnitedHealthcare stands out. UnitedHealthcare manages one of the largest networks in the country.

Their coverage gives patients access to over 1.3 million doctors and care professionals and more than 6,500 hospitals and care facilities nationwide. With this level of access, families can find a plan suited for their needs while enjoying a wealth of choices across primary care providers and specialists.

UnitedHealthcare plans offer flexibility unmatched by many other companies offering health insurance benefits. Individuals or families can select from Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or Medicare Advantage Plans based on what fits best with their lifestyle or medical needs.

Plan features may include virtual visits, prescription savings programs, dental options, and wellness support tools as covered services. People who qualify for Medicaid or need Children’s Health Insurance Program coverage will find individual solutions here too since UnitedHealthcare partners closely with state-administered programs under the Affordable Care Act regulations.

https://www.youtube.com/watch?v=H3619sZZbo0

Conclusion

You have explored major health insurance plans like Blue Shield, Healthcare.gov, and UnitedHealthcare. Each one offers unique benefits for individuals or families with many coverage options and Medicare plans included.

Choosing the right health insurance plan improves your access to quality care and trusted providers while helping you manage costs efficiently. These strategies simplify a complex decision by focusing on clear information, income-based options, and open enrollment periods for better choices.

For more guidance or to see plans available in your area, reach out to licensed health professionals who can help explain services covered based on your needs. Taking action today supports a healthier tomorrow for both you and your loved ones; I have seen careful planning protect family medical goals year after year.

If you’re seeking legal assistance regarding health-related issues, consider consulting with a trusted mesothelioma lawyer.

FAQs

1. What are some of the top health insurance plans available?

Some of the best health insurance plans offered include those from Blue Shield, Healthcare.gov, UnitedHealthcare, and others like Aetna Life Insurance Company and Medicare.

2. How can I find the right health insurance plan for me or my family?

Finding the right health insurance plan requires understanding your specific needs. Consider factors such as coverage through your employer, income level, preferred healthcare providers, and whether you need individual or family medical care.

3. What benefits do these top-rated health plans offer?

Each specific plan offers different benefits based on a variety of factors including individual requirements and share costs arrangements with healthcare providers. It’s crucial to understand what services are covered under each plan before making a decision.

4. When can I enroll in these top-rated health insurance plans?

Most insurers have an open enrollment period where you can sign up for coverage. However, certain life events may qualify you for special enrollment outside this period.

5. How does income factor into finding quality coverage?

Many plans may adjust their rates based on your income level; lower-income families could potentially qualify for subsidized programs like Children’s Health Insurance Program or Managed Care options under Medicare.

6. Are there resources to help me see which plans are available in my area?

Yes! Websites like Healthcare.gov provide information about different life insurance policies and allow users to compare various medicare plans that they might be eligible for.